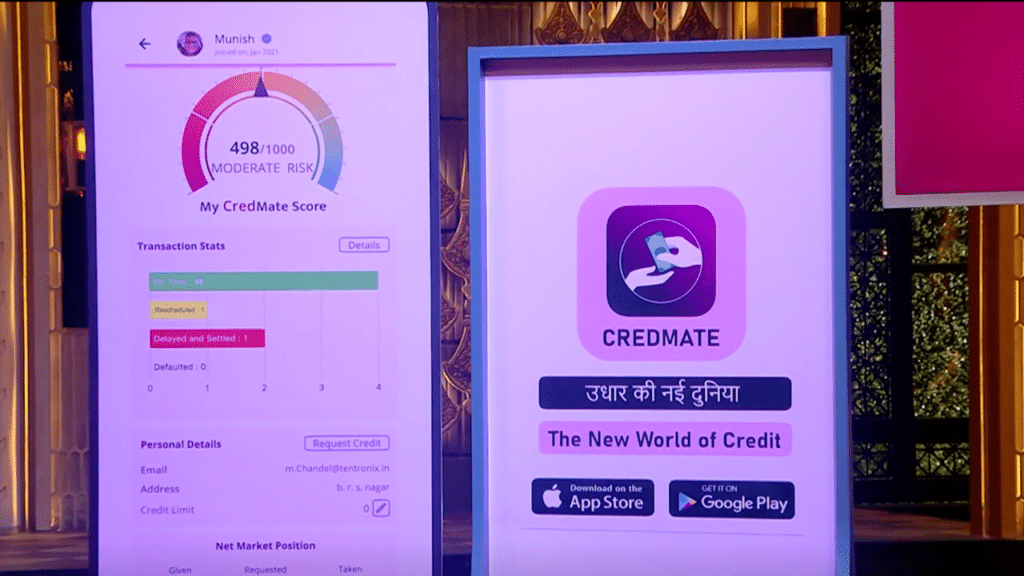

Credmate is a platform designed to help lenders identify and avoid habitual defaulters in the unorganized lending sector. It collects and organizes data on individuals who frequently default on loans, enabling lenders to perform background checks before offering loans. This reduces the risk of lending to unreliable borrowers. Credmate aims to provide a safer, more informed lending process for those in the money lending business by leveraging data and analytics to track borrower behaviour.

Company Name: CREDMATE

Founder: Gaurav Kundra & Gaurav Sharma

Product: Money Management

Highlights

1.Credmate gathers and examines borrower repayment history to assist lenders in spotting regular defaulters in the unorganized lending market.

2. Lenders can conduct extensive background checks on possible borrowers, therefore lowering the risk of lending to unstable or high-risk people.

3. Targeting the unorganized loan market, which often lacks appropriate mechanisms for evaluating borrower dependability, the solution especially addresses this sector focus.

4. Providing a single database of defaulters enables Credmate support safer financial transactions and aid to reduce lending risks.

5. Credmate enables lenders to make more confident and informed decisions grounded on data analytics.

6. Market Potential: Particularly in areas where conventional credit scoring methods might not be available or relevant, the platform fills a vital demand in the money lending scene.

Pitch Details

Ask: ₹50 lakhs for 5% Equity (Valuation: ₹10 crores)

Deal: After negotiations, deal couldn’t happen

Investors: NO DEAL

Conclusion

Through thorough data analysis, Credmate gives lenders the tools to spot habitual defaulters, so offering a useful answer to the disorganized lending market. Encouragement of informed background checks helps to reduce the hazards involved with lending to unreliable borrowers. Although the product fills a major void in the market, especially in the unorganized sector, its appeal on Shark Tank India finally failed to attract investment since the sharks voiced worries about scalability and the difficulties using the platform for monetization. Notwithstanding this, Credmate’s creative approach to risk management and its possibilities to streamline the lending process still stand out.

Key Takeaways from the Episode

1. Scalability Matters: Companies must show obvious room for expansion to draw in capital.

2. Risk in Unorganized Sectors: Ventures like Credmate struggle to show profitability and environmental viability.

3. Innovation by itself is insufficient; special items like Freebowler need solid business ideas to attract sales.

4. Key are well-defined business plans. Insufficient sound financials and projections makes attracting investment interest difficult.

5. Negotiations call for flexibility in terms to clinch transactions. Entrepreneurs must be ready to change them.