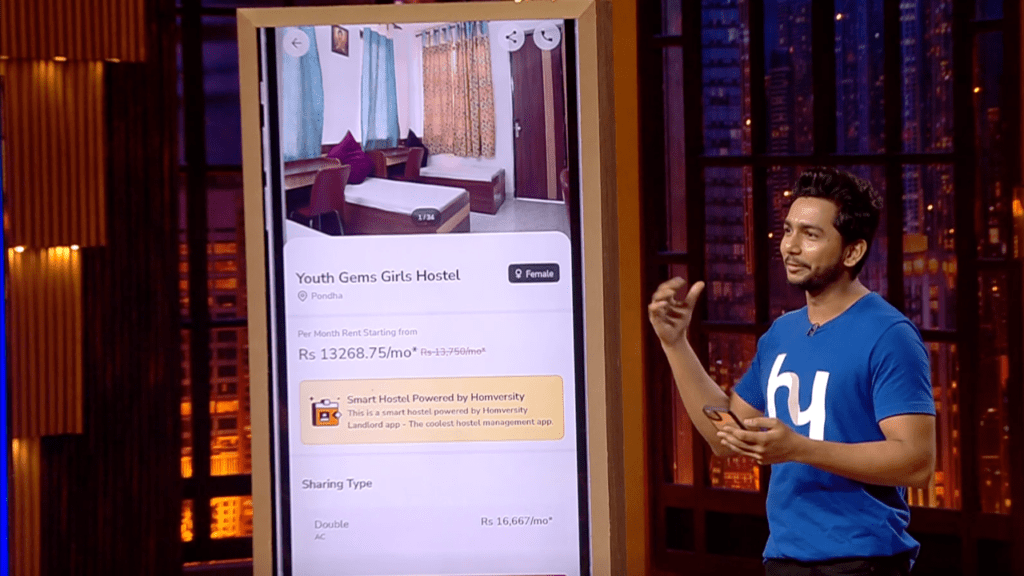

The Sharks heard a proposal from Homversity, a firm that aims to digitize the student housing market in India. The business provides a platform that links students with trustworthy and reasonably priced housing options, resolving one of the main problems that Indian students encounter: locating suitable housing. By providing a controlled online marketplace, the site aims to close the gap between students and trustworthy student housing options. Students can utilize this platform to locate vetted houses near their campuses that offer features like meals, security, Wi-Fi, and more. For both students and property owners, the creators want to provide an open, reliable, and hassle-free experience.

Company Name: Homversity

Founder: Saurav Kumar Sinha

Product: Digitalizing India’s student housing community

Highlights

- The founder emphasized how difficult it is becoming for students to find safe, dependable, and reasonably priced housing in cities, especially close to their educational institutions. Unverified advertisements, exorbitant rentals, and untrustworthy landlords are common features of the conventional home search methods.

- The founder highlighted the business’s scalability, particularly in light of India’s sizable and expanding student body.

- With millions of students annually relocating to different locations for higher education, India has a sizable student housing sector. By offering a one-stop shop for both students and property owners, Homversity aimed to capitalize on this expanding industry.

- The Sharks were worried about a number of business-related issues, even though the market was huge and the need for student housing options was increasing. Investors were unconvinced by the valuation and questioned the founders’ capacity to grow the company.

- The platform’s scalability was questioned, as was the company’s capacity to handle the operational challenges—such as onboarding landlords and guaranteeing home quality.

- The business suggested that both landlords and students may benefit from a more streamlined and transparent approach by centralizing postings and confirming properties.

- Some of the Sharks also appeared to be troubled by the company’s valuation, questioning whether it was asking too much for such a small ownership.

- None of the investors were prepared to proceed with a deal, even though the Sharks saw the potential in the student housing market. The Sharks finally decided not to invest due to issues with execution, valuation, and scalability.

Pitch Details

Ask: ₹65 Lakhs for 2% equity

Deal: No Deal

Conclusion

The opportunities and difficulties in India’s student housing sector were emphasized in Homversity’s presentation. Despite the idea’s potential, the creators failed to persuade the Sharks of the viability and feasibility of their business plan. The absence of a contract illustrates the difficulties that new businesses frequently encounter when trying to secure funding, particularly in sectors that are highly competitive and demand intensive operational management.

It would be interesting to watch how the firm develops after the pitch, even though Homversity did not land a deal on the show. The company continues to serve as a reminder of the growing desire for digital solutions in traditionally offline industries like real estate.

Significant findings

- Challenges in Scaling

- Execution Concerns

- Valuation Disagreement

- Importance of Execution and Proof of Concept

- Room for Improvement

Key Takeaways from the Episode

- An important consideration while looking for investments is the valuation that entrepreneurs provide. Sharks closely examine whether the valuation is in line with the company’s present state and prospects.

- Many businesses, particularly those that are just starting out, worry about how they will grow. Sharks are especially interested in whether the entrepreneurs have the vision, resources, and strategies necessary to grow their company into new markets.

- An important factor is the entrepreneur’s relationship with the investors. Founders should look for investors who share their vision and growth goals and who can provide both financial support and value-added skills.

- Entrepreneurs need to show that they can properly handle risk. Founders must demonstrate that they are equipped to manage risks in the business journey, whether they are financial, operational, or market risks.

- The event serves as a reminder that rejection is a natural part of the entrepreneurial experience, even though some entrepreneurs were unable to close a sale. Success in the future may result from improving the business model and learning from criticism.

- Sharks frequently base their deal-structure negotiations on the stage of the company, its potential for growth, and the entrepreneur’s capacity to defend the offered valuation and ownership position.