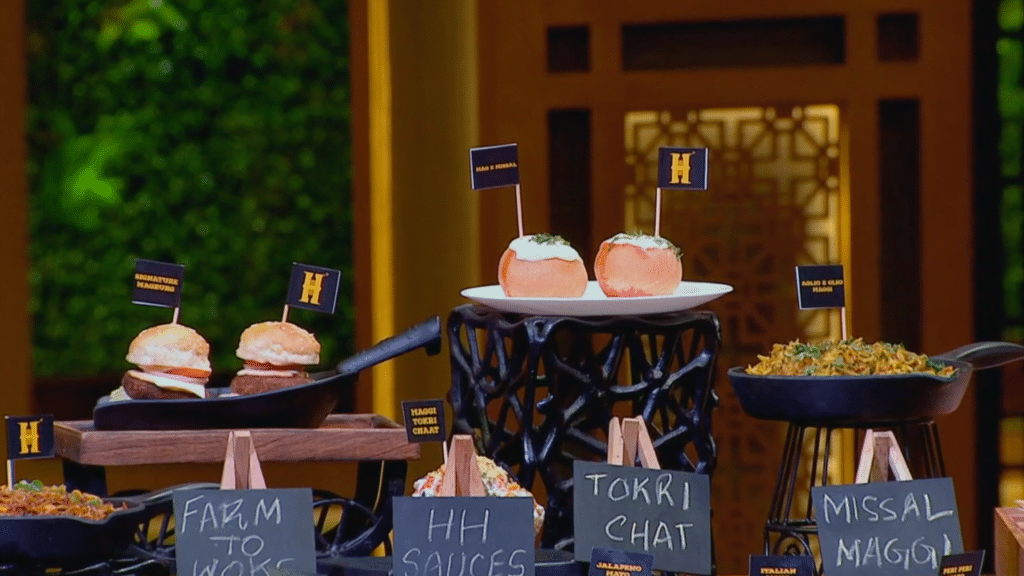

Hungry Heads was pitched as a niche fast-food chain specializing in Maggi-centric offerings that cater to a younger audience seeking quick, affordable, and flavorful options. A creative take on maggi with flavors inspired by global cuisines. Plans to expand across major cities and become a recognizable brand in the fast-food space. On Shark Tank India, the fast-food firm Hungry Heads, situated in Mumbai, pitched as a company that serves inventive and distinctive Maggi-based dishes. By using innovative recipes and a fast-casual dining experience, the owners hoped to capitalize on the popularity of Maggi in India.

Company Name: Hungry Heads

Founder: Arpit Kabra and Rahul Daga

City: Mumbai

Product: It’s All about Maggi

Highlights

- The duo emphasized their passion for redefining fast food by introducing a specialized menu focused on Maggi and related fusion dishes.

- The founders shared their success in local markets, emphasizing strong customer feedback and plans to expand operations.

- The sharks found the valuation high for a business that was still in its early stages, with limited scalability demonstrated.

- The food and beverage (F&B) industry is saturated, with numerous players in both organized and unorganized sectors, making differentiation and profitability challenging.

- The business model lacked a robust plan for scaling and replicating success across multiple outlets.

- With maggi-based dishes already widely available, the brand faced the challenge of building a unique identity.

- The enthusiasm and commitment of the founders were evident, and their understanding of their target audience was clear.

- Fusion dishes and creative menu ideas provided opportunities to differentiate the brand if executed well.

- The sharks appreciated the effort but opted not to invest due to concerns about scalability, profitability, and the competitive nature of the market.

Pitch Details

Ask: ₹50 lakhs for 5% equity.

Deal: No Deal

Conclusion

Hungry Heads demonstrated an innovative and targeted idea with the goal of establishing a market niche for noodle-based foods in the fast-food sector. The sharks, however, voiced worries about the lack of a strong operating strategy, market saturation, and scalability. Despite the brand’s potential, no investment was made because there was no clear differentiation strategy and little evidence of growth.

The pitch emphasized the difficulties of breaking into the food and beverage industry, where scalability, effective branding, and operational efficiency are critical success factors. The experience of Hungry Heads demonstrated how crucial it is to have a tested business plan and a well-defined strategy in order to win over investors in a fiercely competitive market.

Significant findings

- Scalability is Crucial

- Market Differentiation Matters

- Operational and Financial Clarity

- The Importance of Proven Success

Key Takeaways from the Episode

- The very inventive modular EV concept catered to India’s expanding need for electric mobility. Despite their worries regarding scalability and valuation, the sharks were impressed by the entrepreneurs’ product distinction and competence.

- The acquisition was successful because the founders showed flexibility by modifying their valuation. The sharks’ financial assistance and mentoring will help the business grow and succeed in the cutthroat EV market.

- The episode illustrated the complexities of scaling operations in capital-intensive sectors like electric vehicles, where production, supply chain, and competition play significant roles.

- Hungry Heads had a clear niche by focusing on noodles and fusion dishes. However, the sharks felt that the concept, while unique, would face significant competition in the crowded fast-food market.

- Growing the company and differentiating oneself in a crowded market were the primary issues. The sharks chose not to invest in the absence of a solid operational plan and a more effective differentiation approach.

- The lack of proven success and operational clarity in the early stages of the business hindered investor confidence. This showcased the importance of having a solid foundation before pitching to investors.