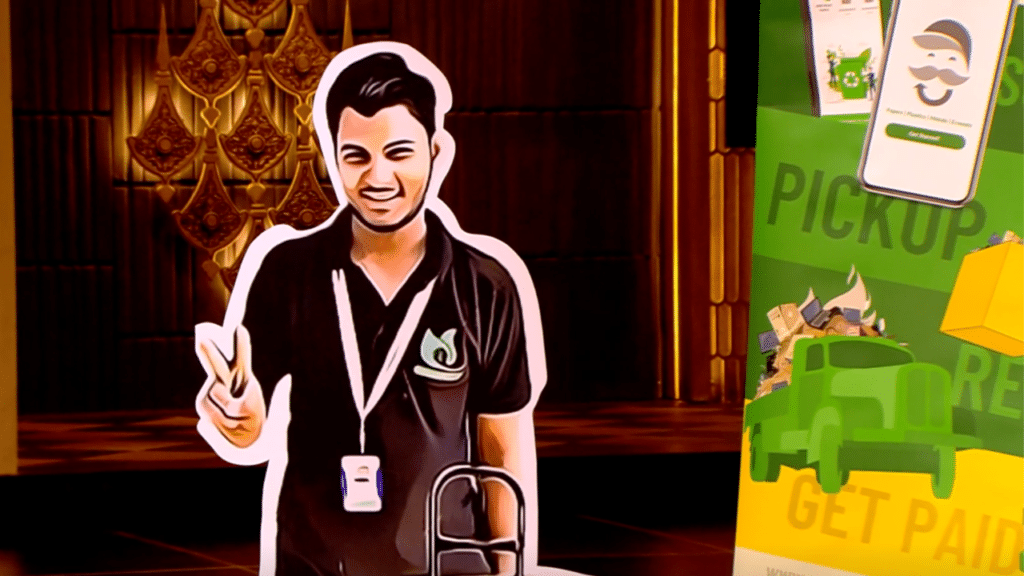

Founded by Mukul Chhabra, a Delhi-based firm, ScrapUncle has changed scrap recycling via its website and app. With trained agents gathering junk from homes and businesses and providing precise weighing and fair compensation for the items, the company seeks to transform India’s recyclable garbage management. Their passion to ethical waste management is shown by their will to “responsible recycling”. For 3% of the firm, ScrapUncle wanted investment of ₹60 lakhs.

Their website and app let one access their services. Every one of their agents picks up the scrap with 100% accuracy and provides you the finest value as they are trained and verified. Their system automates the recycling and scrap can be gathered from several sites. Over 22,000 pickups over the past two years have resulted in over 14 lakh kilogrammes of scrap, which have been recycled from simply Delhi NCR area. Their customer to recyclable gross margin is 45%. Mukul revealed that Scrap Dealer’s monthly income was about ₹35 thousand, which had increased to ₹70 thousand.

From Columbia University, they paid grand of ₹23 lakhs without any equity exchange.

Their monthly sales are ₹27.5 Lakh; their first year, FY20-21 brought in ₹35 Lakh; followed by ₹1.48 Crores in FY21-22. This year they want to close with ₹6 Crores. B2C accounts for 90% of their sales; the rest come from companies. Their CAC is ₹110 and their 4-month cycle shows 50% retention rate. The firm is breaking even out of ₹27.5 lakh.

Company Name: ScrapUncle

Founder: Mukul Chhabra

Product: Scrap Recycling

Highlights

1. Customers may set pickups using a website and mobile app for digital scrap collection.

2. Eco-friendly recycling guarantees conscientious disposal and recycling of scrap.

3. Fair Pricing: Offers open pricing by means of reliable weighing techniques.

4. Operating in Delhi-NCR, it serves households, companies, and workplaces.

5. Over 22,000 pickups done, 1.4 million+ kg of scrap recycled.

Pitch Details

Ask: ₹60 lakhs for 3% equity, valuing the company at ₹20 crores.

Deal: After negotiation Amit Jain finished the deal at ₹60 lakhs for 5% equity.

Investors: The investment came from Amit Jain.

Conclusion By tackling the disorganized scrap sector with a tech-driven, transparent, environmentally beneficial approach, ScrapUncle effectively delighted the sharks. Strong market traction, scalability, and financial growth of the firm made it an interesting investment.

Founder Mukul Chhabra negotiated a contract with Amit Jain for ₹60 lakh at 5% equity, therefore reducing the company’s valuation from ₹20 crore to ₹12 crore despite competition offers. Funding, mentoring, and strategic direction this alliance offers enable ScrapUncle grow and influence.

ScrapUncle is positioned to scale activities and transform trash management in India with a sustainable business strategy, growing income, and obvious social effect.