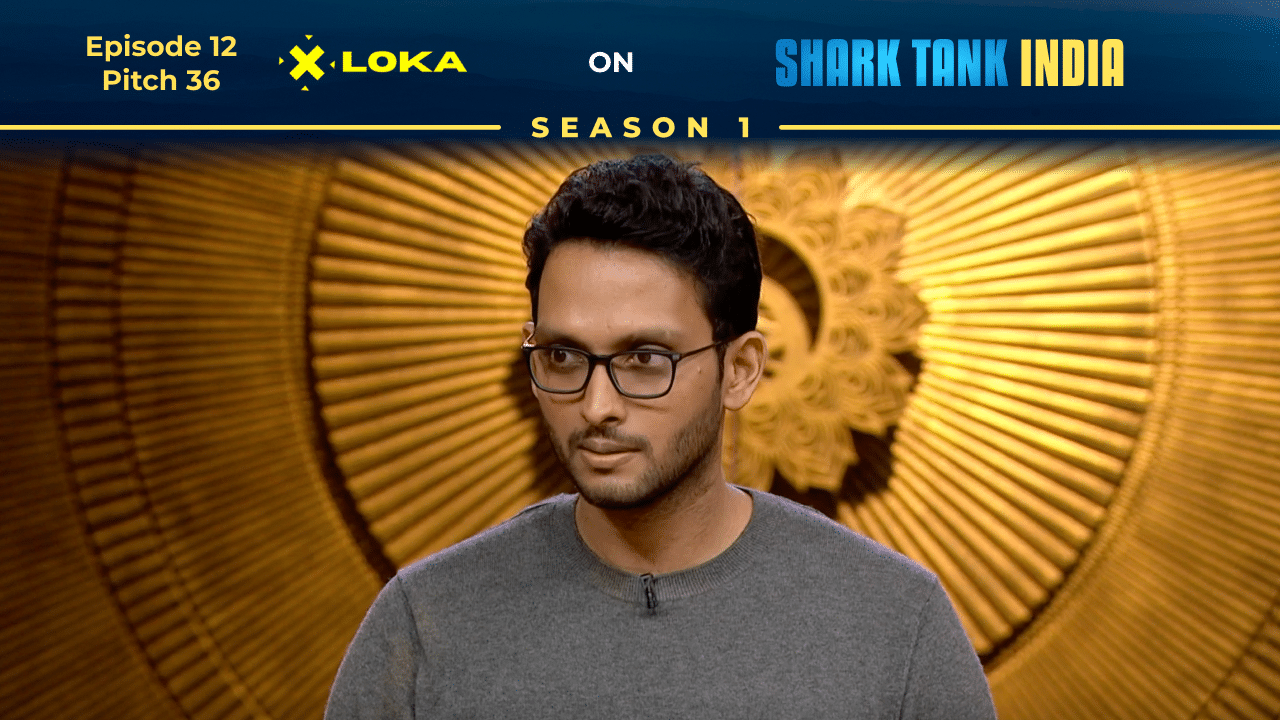

Founded by Krishnan Sunderarajan, Loka is a cutting-edge metaverse-based social game app that integrates real-world locales into a virtual multiplayer setting. It seeks to produce an immersive virtual environment that lets users explore, communicate, and participate in real time, much like they would in actual locations like Delhi’s Connaught Place. With the help of real-world maps, users may virtually buy, play games, and interact with one another in India’s first gamified metaverse. Through the startup’s immersive multiplayer experience, users may communicate with others, play games, and purchase virtually while exploring real-world locales in a virtual environment.

Company Name: Loka

Founder: Krishnan Sunderarajan

Product: Meta-verse Application

Highlights

- Krishnan valued Loka at ₹8 crores and asked for ₹40 lakhs for 5% ownership when he entered the Shark Tank India stage.

- Loka is a hyper-realistic metaverse platform that incorporates real-world sites into its virtual environment.

- Users can interact, play games, connect, and explore real-time virtual cityscapes. Aims to make money through in-game sales, digital events, and brand partnerships.

- The platform aims to develop into a place for companies and enterprises to engage in social gaming and virtual purchasing.

- According to Aman, the concept was novel and forward-thinking, fitting in with worldwide metaverse and Web3 trends.

- Anupam questioned the execution plan and monetization strategy but appreciated the vision.

- Peyush expressed concern about the difficulties in acquiring and retaining users, despite his belief in the concept’s long-term potential.

- Other sharks chose not to participate, claiming that the metaverse is still in its infancy in India, that she was uneasy about investing in it, that the business plan was unclear, and that she had backed out due to market risks and uncertainty in the metaverse domain.

- Following discussions, Peyush Bansal, Anupam Mittal, and Aman Gupta jointly offered ₹40 lakhs for 24% stake.

- With enormous potential in the rapidly changing digital ecosystem, Loka’s proposal stood out as a pioneering entry into the metaverse business. Aman, Anupam, and Peyush’s investment demonstrated their faith in the potential of metaverse-based apps, despite worries about monetization, user acceptance, and execution risks.

- The agreement gave Krishnan access to a large network, financial support, and mentoring, all of which might aid Loka in growing and establishing itself in the Indian gaming and virtual reality markets.

Pitch Details

Ask: ₹40 Lakhs for 5% Equity

Deal: After negotiations, Aman, Anupam and Peyush together secured a deal for ₹40 Lakhs for 24% Equity.

Investors: The investment came from Aman Gupta, Anupam Mittal and Peyush Bansal.

Conclusion

By building a virtual environment based on actual places and providing users with an engaging gaming and social experience, Loka’s proposal demonstrated an inventive idea to introduce the metaverse to India. Sharks expressed reservations about commercialization, scalability, and the early adoption of metaverse technology in India, despite the concept’s futuristic and promising nature. Despite these reservations, Loka’s proposal had potential, and Aman Gupta, Anupam Mittal, and Peyush Bansal invested ₹40 lakhs for 24% equity, offering both financial support and strategic guidance.

Although the deal drastically reduced the original valuation, it provided the founder with access to seasoned businesspeople who might help overcome obstacles and spur expansion. Loka has the potential to become one of India’s most popular social metaverse platforms with proper implementation, but this will rely on user uptake, technical developments, and successful revenue-generating tactics.

Significant findings

- Innovative Concept

- Early-Stage Challenges

- Investor Confidence

- Lower Valuation

- Execution is Key

Key Takeaways from the Episode

- Funding was drawn to Loka’s metaverse concept despite its infancy, suggesting a growing interest in artificial intelligence and virtual platforms.

- Despite having a fantastic idea, SweeDesi was unable to close a deal because sharks expressed worries about scalability, logistics, and competitiveness in the Indian candy market.

- Namita’s investment in Auli Lifestyle strengthened her support for female businesswomen and the Ayurvedic beauty sector.

- Both Loka and Auli Lifestyle received financial support and strategic mentoring, but they were forced to make concessions on their original valuations.

- This episode emphasized the importance of scalability, brand differentiation, and technology-driven innovation in attracting investment. SweeDesi’s inability to show significant distinctiveness and execution potential resulted in a no-deal outcome, but Loka and Auli Lifestyle persuaded the sharks with their distinctive value propositions.